)

SBI Card, ICICI Bank, Axis Bank, and Yes Bank, have recently announced changes to their credit card rules. Photo: Shutterstock

Co-branded credit cards (CBCCs) are outpacing traditional credit cards, driven by India’s booming economy and shifting consumer preferences, and are set to dominate the market with 35-40% compounded annual growth from fiscal year 2024 to 2028 , according to a report by Redseer Strategy Consultants, in collaboration with Hyperface.

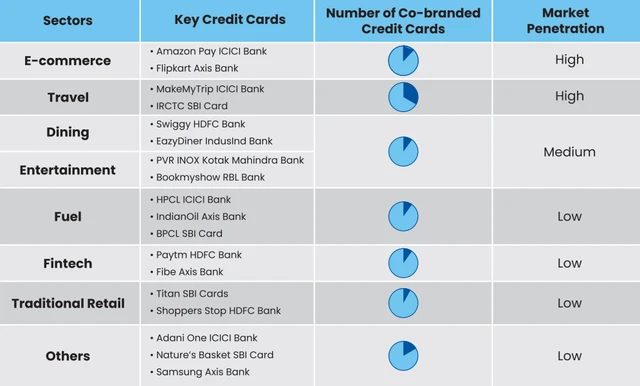

E-commerce dominates the co-branded credit card (CBCC) landscape, commanding 75-80% of all issued cards, with the Amazon Pay ICICI Bank and Flipkart Axis Bank Credit Cards leading the charge, collectively accounting for approximately 9 million cards.

Following e-commerce, the travel sector holds an 8-10% market share, while the dining and entertainment sectors represent 3-5% of co-branded cards.

)

The survey conducted by Redseer showed that majority 47% identified cashback offers as a key method of fostering customer loyalty while 41 per cent pointed to loyalty points programmes.

As consumers increasingly seek personalized financial products, co-branded credit cards have emerged as a key driver of engagement, offering tailored rewards and exclusive benefits through strategic partnerships between banks and brands.

The report highlights that in FY24, CBCCs accounted for 12-15% of total credit cards, with projections showing this share could exceed 25% by FY28. This growth trajectory is twice as fast as that of traditional credit cards.

“Credit cards are revolutionizing consumer behavior by enabling effortless spending and driving consumption. Co-branded cards have evolved from travel rewards to essential industry drivers, offering tailored value propositions that meet consumer needs and fostering loyalty through multiple card options”, said Praveena Rai, COO, NPCI.

The report also highlights the strong impact of CBCCs on customer engagement, with activation rates reaching an impressive 70%, significantly higher than the 50% seen with traditional credit cards. This success is largely driven by cashback offers and loyalty points programs, which have emerged as the most effective strategies for boosting customer retention.

Survey insights reveal that 65% of key decision makers believe launching a co-branded credit card is a powerful tool for increasing customer loyalty.

“India’s economy has undergone significant transformation in recent years, driven by rapid digitization and increased consumer spending. This has led to the rise of co-branded credit cards (CBCCs), which combine the strengths of financial institutions and partner brands to offer tailored benefits and enhance the value proposition for consumers. As CBCCs gain traction, they are poised to become a dominant force in the financial ecosystem. With continued growth projections and the evolving role of technology, CBCCs will enable brands to deliver more personalized, engaging, and rewarding experiences, shaping the future of financial products in India,” said Jasbir S Juneja, Partner, Redseer Strategy Consultants.

First Published: Aug 27 2024 | 11:25 AM IST