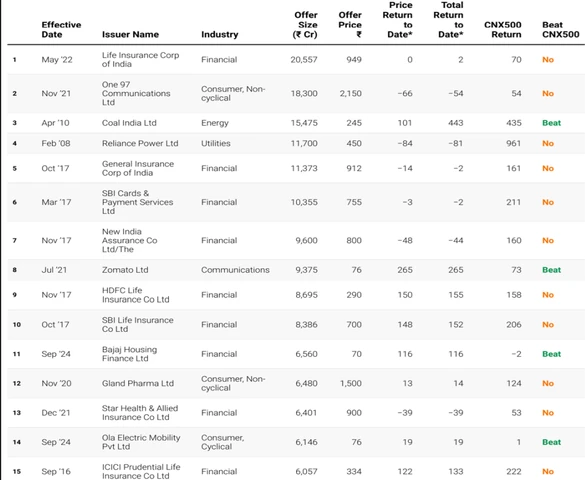

Only 2 of the top 10 biggest IPOs have beaten the CNX500.CNX500 or Nifty500 is a broad-based index that is composed of the top 500 listed companies on NSE.

CapitalMind analyzed historical data on the top 30 Indian IPOs by size, examining factors like offer size, industry sector, price returns and total returns including dividends. The results may surprise you – while some IPOs like Zomato and Sona BLW Precision Forgings have outperformed, most of the largest IPOs have failed to beat the broader CNX 500 index, with some like Reliance Power even delivering negative returns. Before investing in the next hot IPO, learn what the data shows about the risks and rewards.

)

)

.

Key Findings:

Poor Performers: Eight of the 30 IPOs have delivered negative returns, with Reliance Power being the most notable example. It was the largest IPO at the time, but its performance has disappointed many investors.

Only a Few Winners: Among the top 30, only two IPOs from the top 10 have outperformed the CNX500 index. Coal India, which has roughly doubled in price over the past 14 years, still only matches the index when considering its dividends.

Zomato Stands Out: Zomato is the only IPO in the top 10 that has significantly exceeded market returns. Other successful IPOs from the top 30 include Hindustan Aeronautics, Indian Railway Finance Corp, Sona BLW Precision Forgings, and ICICI Lombard.

Out of the 30 IPOs, only 12 would have given investors a better return than buying and holding the broad-based index.

Overall, mega-IPOs don’t seem to offer lucrative returns. CapitalMind explains why:

There are several potential reasons. Large IPOs tend to arrive after a bull market has been underway for a while, so they tend to be priced optimistically in keeping with the prevalent appetite for risk. While the specific reasons for large IPO underperformance vary, combining the massive supply of shares these IPOs bring with the higher earnings growth expectations given the aggressive pricing tends to punish any disappointment in growth quickly.

“Overall, big IPOs have struggled to deliver excess returns for the investors. IPOs abound in bull markets since they get optimistic valuations and most late-stage bull markets are characterised by a few large IPOs which tend to be valued optimistically. When the earnings growth to justify those valuations does not materialise combined with a mean-reversion in broader markets, high-profile IPOs end up delivering lower than expected returns,” said Anoop Vijaykumar, Investments & Head of Research, Capitalmind Financial Services.

By industry, Financials have traditionally dominated public market fund-raising. Even in 2024, 27% of funds raised were by Financials. However, Consumer companies (cyclical and non-cyclical) have emerged as the largest industry category in 2024, thus far. Consumer companies have attributed 34%of the funds raised in 2024, followed by Financials at 27% and Industrials at 14%.

)

First Published: Oct 16 2024 | 2:04 PM IST