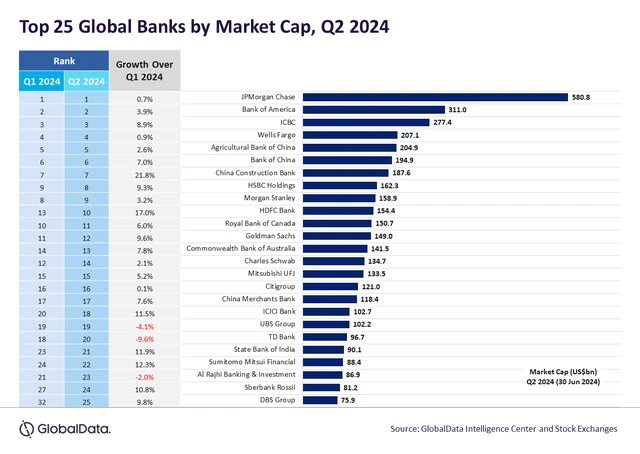

The combined market-capitalisation (market-cap) of the top 25 banks globally rose 5.4 per cent quarter-on-quarter (QoQ) in the April – June 2024 period (Q1-FY25) at $4.11 trillion driven by favorable global economic signals, suggests a recent note by GlobalData, a leading London-based leading data and analytics firm.

China Construction Bank (market-cap of $187.6 billion at the end of June 2024 quarter) and HDFC Bank (market-cap of $154.4 billion) stocks recorded over 15 per cent growth in the recently concluded quarter, GlobalData said, while TD Bank saw a decline of nearly 10 per cent in market value during the period under review. (See table)

JPMorgan Chase with a growth of 0.7 per cent in market-cap to $580.8 billion retained its position as the most valuable bank globally for the ninth consecutive quarter, the report said, reflecting resilient performance amid evolving economic landscapes.

“Bullish investor sentiment was driven by an expected interest rate cut by the US Federal Reserve (US Fed) in September 2024. Overall, investors remain optimistic about banking stocks as central bank rates in the range of 5.25-5.5 per cent stabilize deposit costs, thus easing net interest margin pressure. A strong economy and an expected modest improvement in lending could offer a stable net interest income for banks,” said Murthy Grandhi, company profiles analyst at GlobalData.

)

Global banks

HDFC Bank’s market value gained 17 per cent to end the June quarter with a market-cap of $154.4 billion. Strong quarterly results that met investor expectations and rising optimism about the bank’s future performance were the catalysts, GlobalData said. HDFC Bank, it said, is expected to reclaim its industry-leading profitability going ahead, benefitting from an improved loan mix and normalised funding costs.

The market value of China’s top four banks – ICBC, Bank of China, Agricultural Bank of China, and China Construction Bank – experienced growth in the range of 3 per cent-22 per cent and saw a dip in NIMs for the quarter ending in March 2024 due to various factors, including a reduction in the loan prime rate and low market interest rates, the report suggests.

Economic conditions, monetary policies, and inflation are some of the factors, according to Grandhi of GlobalData, that are likely to shape the performance of the banking industry in the second half of 2024.

“Geopolitical factors, including trade tensions and conflicts, could affect international operations and market stability. Regulatory scrutiny, as seen with TD Bank, will also impact strategic initiatives and performance. Overall, while challenges remain, the combination of potential rate cuts, economic resilience, and technological progress may benefit global banks,” he adds.

First Published: Jul 12 2024 | 2:38 PM IST