)

With India witnessing lower local costs, many price-sensitive buyers are now opting for heavier jewelry pieces. Image: Bloomberg

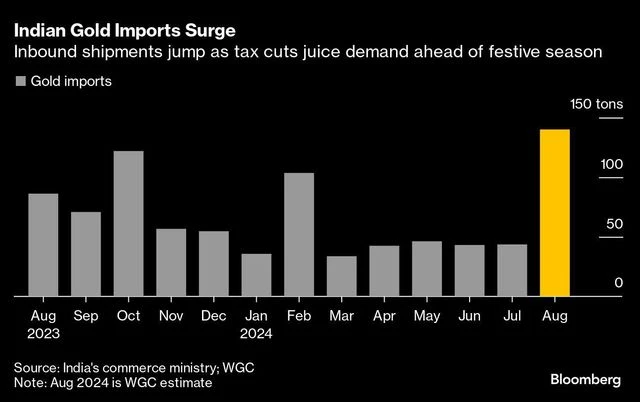

Indian gold demand looks set for a strong few months as a cut to the import tax and what’s likely to be a buoyant festival and wedding season drive purchases in the world’s second-biggest consumer of the precious metal.

)

Jewelry buying will gather pace in a couple of weeks as the world’s most-populous nation enters the festival and wedding season — when wearing and gifting gold is considered auspicious. Hindu festivities will culminate with Diwali in November, while December and January would be busy months for marriages.

“The pro-gold policy measures are positively impacting the domestic gold market,” said Sachin Jain, regional CEO for India at the World Gold Council.

The changes could help add 50 tons or more to gold demand in the second half of 2024 versus last year, he said, adding that overall requirements could be between 750 tons and 850 tons this year.

The momentum comes after inbound shipments rose just 4.8 per cent from a year ago to 305 tons in the first half of this year, according to the commerce ministry.

The purchases reinforce the South Asian nation’s position as a global bright spot for physical consumption, at a time when jewelry purchases have tanked in the biggest buyer China. Consumers there have grappled with an economic downturn during what should be one of the busiest times of the year.

With India witnessing lower local costs, many price-sensitive buyers are now opting for heavier jewelry pieces, bucking a long-term preference for cheaper lightweight items, said Chirag Sheth, principal consultant for South India at Metals Focus. “Suddenly you’ve seen gold cheaper by 9 per cent — and all those people who were waiting on the sidelines for the prices to drop have all rushed to the market.”

It’s not just physical gold that’s drawn attention. Net additions to Indian gold-backed exchange traded funds have been positive for four straight months, with inflows hitting a record in August, according to the WGC.

As Indians pour trillions of rupees into an increasingly hot local stock market, bullion-backed ETFs have become a portfolio diversifier for the average investor who typically trades in equities only, said Gnanasekar Thiagarajan, director at Commtrendz Risk Management Services.

In India, it’s always “touch and feel,” he said. “We go to the jewelry store, negotiate with the sellers. But for the first time, people are investing in paper gold via the ETF route. It’s a very new experience for the country.”

First Published: Sep 26 2024 | 7:51 AM IST