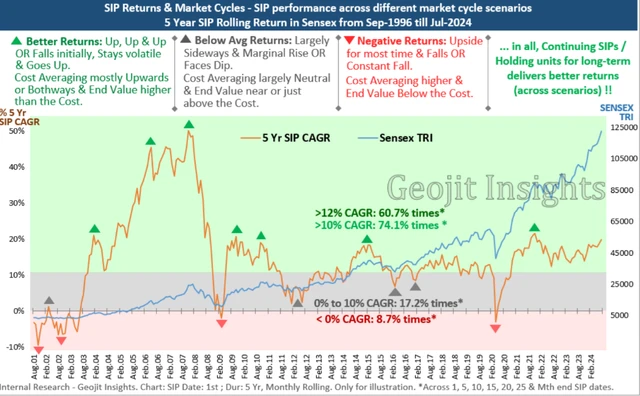

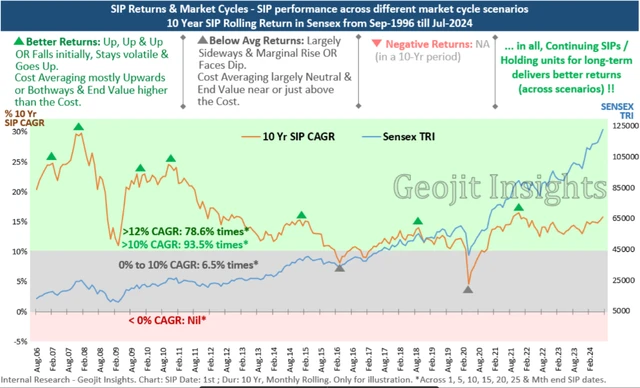

A recent study by brokerage Geojit showed that 74% of 5-year SIP returns in the Sensex exceeded 10% CAGR while 60.7% times, returns were above 12% CAGR, demonstrating the power of long-term investing. While SIPs cannot guarantee returns in all market conditions, they can help mitigate the impact of short-term volatility. Continuing SIPs during periods of lower returns can lead to improved long-term performance.

)

)

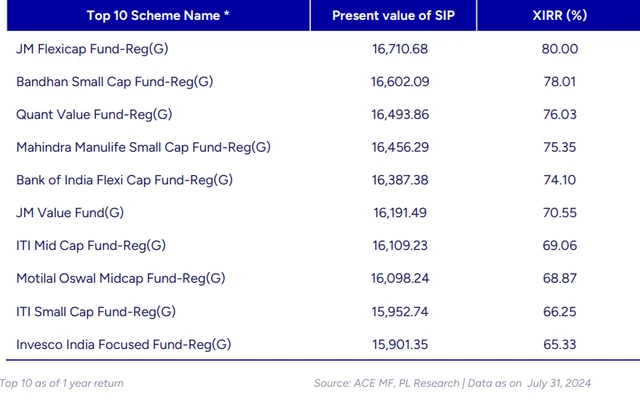

Monthly Investment on 1st of every month, between Aug 01, 2023 to Jul 01, 2024. Valuation date: July 31st , 2024. Total Investment: Rs 12,000

)

Source: Based on data compiled by PL, the wealth management arm of brokerage Prabhudas Liladhar.

-

Flexicap and small-cap funds have consistently outperformed their peers, -

The presence of funds from various asset classes highlights the importance of diversification in achieving long-term returns. -

While some funds have generated higher returns, it’s essential to consider the associated risk factors. -

Investors should carefully evaluate their risk tolerance and investment goals before making investment decisions.

While these above funds have delivered impressive results, past performance is not indicative of future returns. Investors should conduct thorough research or consult with a financial advisor before making any investment decisions.

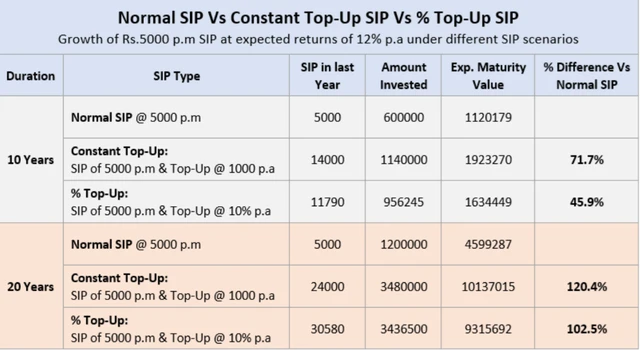

A normal SIP involves investing a fixed amount consistently. However, a top-up SIP offers the flexibility to increase the investment amount periodically. This can be done in two ways:

-

Fixed Amount: Increase the SIP amount by a predetermined fixed amount at regular intervals. -

Percentage Increase: Increase the SIP amount by a specified percentage of the original investment amount.

)

Source: Geojit Insights

Disclaimer: Remember, investing in mutual funds involves risks, and there’s no guarantee of consistent returns.

First Published: Aug 21 2024 | 9:17 AM IST