Hindenburg Research on Sebi chairperson Madhabi Puri Buch, IIFL: Markets are likely to see a knee-jerk reaction at best on Monday, a day after US-based short-seller Hindenburg Research alleged that Securities and Exchange Board of India (Sebi) chairperson Madhabi Puri Buch along with her husband, Dhaval Buch, had stake in obscure offshore entities used in the alleged Adani money siphoning scandal.

The Sebi show cause notice, Hindenburg Research said, claimed that their report was “reckless” for quoting a banned broker with specific experience dealing with SEBI who detailed how the regulator was fully aware that firms like Adani used complex offshore entities to flout rules, and that the regulator participated in the schemes.

How will markets react to Hindenburg allegations on Sebi’s Madhabi Puri Buch?

Analysts believe that these statements are mere allegations, which, at best, can trigger a knee-jerk reaction in the markets when they open for trade on Monday.

“There can be a knee-jerk reaction in the markets reaction to Hindenburg’s report on the Sebi chairperson as these allegations are against a sitting Sebi chief. That said, the recovery in the markets should be equally swift. The problem will arise only if Sebi chairperson Madhabi Puri Buch is asked to go on leave due to these allegations – something we saw earlier with Chanda Kochhar’s case at ICICI Bank,” said Ambareesh Baliga, an independent market analyst.

Connection between Madhabi Puri Buch, Dhaval Buch and IIFL

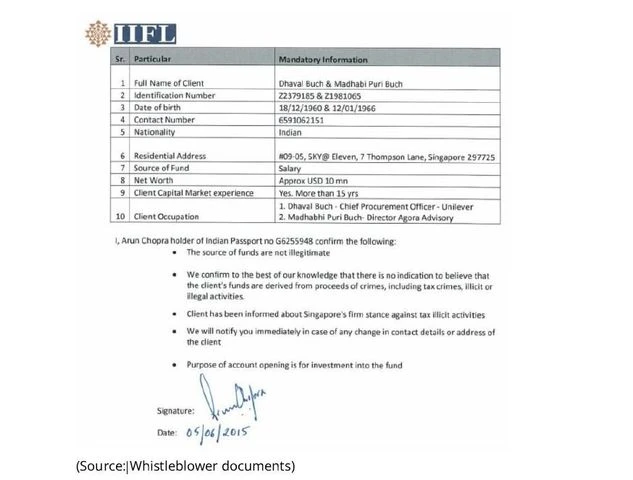

Madhabi Buch and her husband Dhaval Buch, Hindenburg said, first appear to have opened their account with IPE Plus Fund 1 on June 5, 2015 in Singapore, per whistleblower documents. A declaration of funds, signed by a principal at IIFL states that the source of the investment is “salary” and the couple’s net worth is estimated at $10 million.

)

Hindenburg Research on IIFL connection

“If Sebi really wanted to find the offshore fund holders, perhaps the Sebi chairperson could have started by looking in the mirror. We find it unsurprising that Sebi was reluctant to follow a trail that may have led to its own chairperson,” Hindenburg has alleged.

Analysts decode Hindenburg Research allegations and market impact

G Chokkalingam, founder and head of research at Equinomics Research, too, believes that what Hindenburg has said are mere allegations and they do not believe in such reports.

“The markets are likely to remain mostly stable on Monday,” Chokkalingam said.

Sebi, Kranthi Bathini, director-equity strategy at WealthMills Securities said, has strong internal processes and the development can create sentimental short-term impact, but nothing significant will come out of this.

“This is more about internal operations of Sebi and employee compliances. Markets are mature and will look through this. There will be no panic-like situation, and any dips will be bought into,” he said.

The allegations made by Hindenburg Research have a lesser bite than on previous occasions, said U R Bhat, co-founder & director at Alphaniti Fintech and may not impact market sentiment much.

“The allegations look over the top. Even when the allegations were first made against the Adani group, the stocks have come back with a bang. The latest set of allegations are indirect and do not mean much. The markets will bounce back after a knee-jerk reaction, if any,” Bhat said.

First Published: Aug 11 2024 | 10:30 AM IST