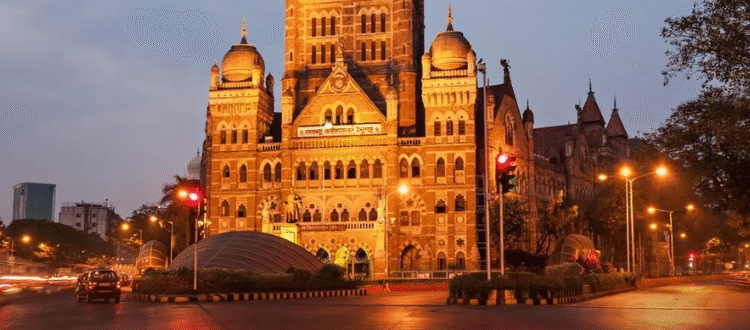

The BMC will auction four properties in Mumbai to recover long-pending property tax dues — marking its first such move in 40 years, officials confirm

In a landmark move, the Brihanmumbai Municipal Corporation (BMC) has announced that four properties in Mumbai will be put up for auction on October 29, 2025 as part of efforts to recover long‐pending property tax dues.This is the first time in around four decades that the civic body has resorted to auctioning properties for this purpose. The auction drive underlines the BMC’s increasing urgency in addressing revenue shortfalls and strict enforcement of tax compliance.

The Why: What Led to the Decision

Revenue pressure

The BMC has been facing a dip in its fixed‐deposit reserves over the past few years — according to an official briefing, the funds fell from ₹ 91,690 crore in 2021-22 to ₹ 79,498 crore in 2024-25. While property tax remains a major revenue stream (the BMC collected a record ~₹ 6,011 crore in 2024-25) the civic body has also reported significant arrears. For instance, 3,605 properties were attached for non‐payment between April and November of a recent year, but collection from them was only about ₹218.96 crore against dues of ₹1,672 crore.

Build‐up of arrears & enforcement gap

According to reports, cumulative unpaid property tax dues in the city—including penalties—have reached approximately ₹ 22,000 crore in some estimates.Over many years, defaulting on property tax has often meant notices and penalties, but few such high‐profile enforcement actions. The auction move signals a shift toward more aggressive recovery.

Legal framework

The auction is being carried out under Section 200(2) of the Mumbai Municipal Corporation Act, 1888, which empowers the BMC to sell properties “as‐is‐where‐is” if tax dues remain unpaid.

The What: Details of the Auction & the Properties

The four properties selected for the auction are diverse in size, location and type:

| S No. | Property | Size & Location | Base Price |

|---|---|---|---|

| 1 | Land parcel of Shanti Sadan CHS at Chunabhatti | ~2,570 sq m | ₹ 47.09 crore |

| 2 | Land of Housing Commissioner (Bombay) at Chembur’s Subhash Nagar | ~3,073 sq m | ₹ 37 crore |

| 3 | Private house with shops at South Mumbai’s Kalbadevi (Abdul Rehman Street) | ~1,648 sq m | ₹ 26.01 crore |

| 4 | Privately owned “Rajani Bungalow” at Borivali | ~624 sq m | ₹ 10.43 crore |

An external agency has been appointed to conduct the online auction. Registration for bidders is already underway. The minimum base price for all properties combined is set at around ₹ 120.53 crore.

Process & timeline

- Notice about auction sent to defaulters, properties posted for public view.

- Online registration of bidders (deadline ahead of Oct 29).

- Auction to be held on October 29 at 12:00 pm.

- If bids are insufficient (minimum three bidders per property required), the BMC may extend deadlines or re‐auction.

The Who: Stakeholders & Their Roles

- Defaulters/Property owners: The properties chosen have dues that could not be recovered despite notices, attachments and long legal processes. For example, the Rajani House has seven registered owners; much of the delay stemmed from disputes over which owner pays what.

- Civic administration & BMC: The Assessment & Collection Department, led by Deputy Municipal Commissioner Vishwash Shankarwar, is spearheading the move. The civic body wants the auction to serve as a deterrent and an institutional response to chronic non‐payment.

- Potential bidders/Investors: These properties being in prime locations might attract investors, but as of two weeks before the auction, no bidder had registered for any of the four properties.

The Challenges & Risks

Low initial interest

Despite prime locations and substantial base prices, the BMC found zero registrations by the three‐week mark before the auction. Officials were reportedly surprised. Mumbai Live+1 This raises questions about market appetite under the “as‐is‐where‐is” condition and unknown liabilities.

Legal entanglements

Many defaulters have long‐pending litigation, joint ownership disputes, and unclear titles. For instance, the Rajani House had to await legal clarity on owner shares before being listed. These complications may deter bidders who fear hidden liabilities.

Property condition & occupancy

Some properties may be occupied or have tenants, which may complicate transfer of possession and eviction. The auction note states “as‐is‐where‐is” basis, meaning new owners accept such risks.

Public perception & backlash

For some, this enforcement marks a positive step in civic accountability. For others, it raises concerns: small defaulters may feel risk of heavy enforcement, or confusion over why large corporate defaulters are not being auctioned equally. Political opposition has pointed to the large dues from government/private entities that still remain uncollected.

Impact & Implications

For the BMC

- If successful, the auctions could contribute a significant one‐time boost to revenue and send a strong signal about tax enforcement.

- It may encourage other defaulters to pay up rather than face public auctions.

- But if no bids or poor participation result, it could raise questions about the strategy’s efficacy.

For property owners & general public

- The auction may create anxiety among property owners about the consequences of default.

- Prospective buyers may now notice “defaulter auctions” as a niche asset class, but with risks.

- Ordinary homeowners will notice the BMC’s tougher stance; some may feel relief if they’ve been paying regularly, while others may worry about fairness.

Broader municipal finance & civic governance

- The move reflects a trend in urban local bodies (ULBs) to intensify revenue‐generation efforts amid budget constraints.

- It may push other municipal bodies across India to adopt similar auctions.

- It also opens questions about fairness, transparency in auction process, property rights, and whether due process is being followed effectively.

What to Watch Next

- Auction outcome: Did the properties receive bids? What were the final sale prices?

- Participation levels: How many bidders registered? How many properties were actually sold?

- Extent of enforcement: Will BMC roll out auctions beyond these four properties? Some notices indicate auctions for five additional properties are already being prepared.

- Defaulter behaviour: Will large defaulters—especially corporate/government‐linked entities—face auction or other recovery action?

- Public reaction & judicial challenges: Given title disputes and occupancy issues, new owners may face legal hurdles; how this plays out will matter.

Expert & Analyst Commentary

“Auctioning properties for tax dues is a serious step. It tells defaulters that the civic body is willing to go beyond mere notices.” said one civic official (anonymous) in an interview.

Real‐estate analysts suggest that while prime parcels may attract interest, the “as‐is” nature and potential liabilities (tenant eviction, title clarity, outstanding dues beyond tax) make it a niche risk market.

Legal experts caution that such auctions must strictly follow procedural safeguards, ensure notice‐periods, and transparent bidding; otherwise there may be post‐sale litigation, which could delay revenue realisation.

Conclusion

The BMC’s decision to auction four properties to recover tax dues marks a milestone in its enforcement strategy — the first such exercise in around 40 years. At a time when municipal finances are under strain, this move signals that the civic body is shifting from passive notice‐issuance to active recovery. Whether the strategy succeeds will depend on bidder interest, legal clarity of properties, and the civic body’s ability to scale this up without generating public backlash. For Mumbai, this is as much about revenues as it is about building a culture of compliance.

If you’re a property owner, investor, or simply interested in how urban governance plays out in Mumbai, this story is worth following closely.

Also Read : Bigg Boss 19: Amaal Mallik to exit the show due to health issues: Reports

Categories

Categories