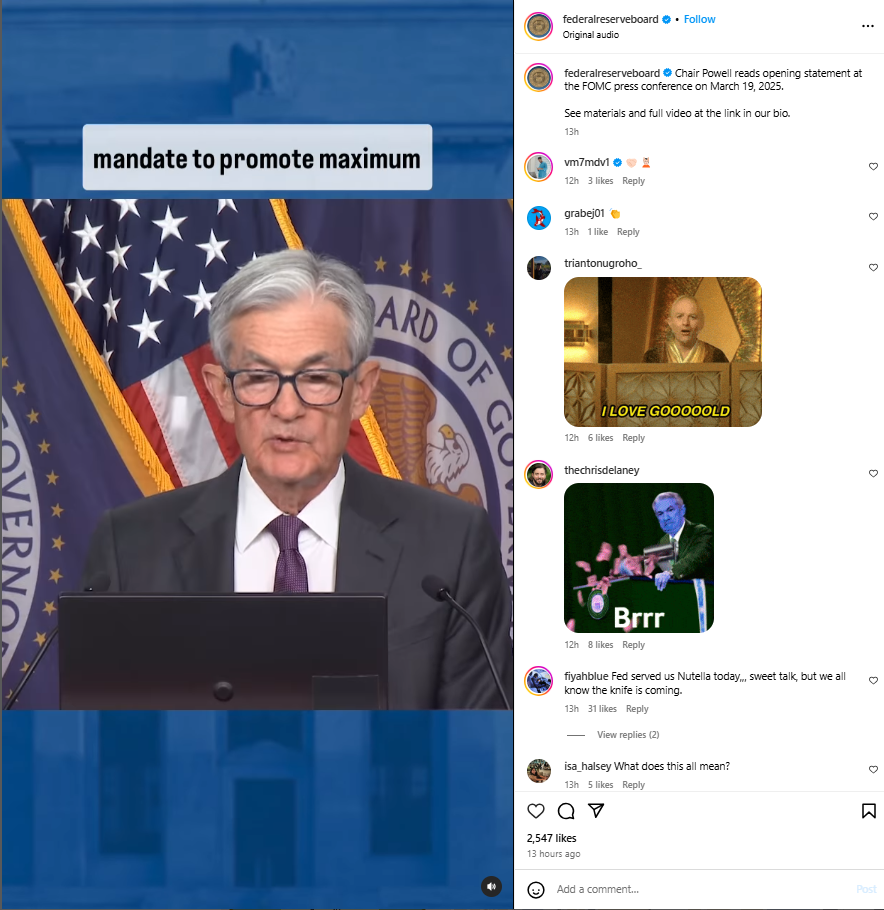

The recent U.S. Federal Reserve meeting has left Indian stock market investors balancing optimism with caution. On one hand, the possibility of rate cuts has created a bullish sentiment, while concerns over trade tariffs continue to pose risks. The Fed’s stance is expected to have a significant impact on global financial markets, including India.

One of the biggest positives emerging from the meeting is the growing expectation of rate cuts. A lower interest rate environment in the U.S. tends to benefit emerging markets like India in multiple ways. First, it makes Indian equities more attractive to foreign institutional investors (FIIs) as lower yields in the U.S. push them to seek higher returns elsewhere. This could lead to increased capital inflows, providing a boost to Indian stocks. Second, a softer U.S. dollar due to rate cuts helps stabilize the Indian rupee, reducing inflationary pressures and making imports more affordable. Lastly, looser monetary policies improve overall liquidity conditions, benefiting key sectors such as banking, infrastructure, and consumer goods.

Despite the optimism surrounding rate cuts, trade tensions remain a potential risk. Any new tariffs imposed by the U.S. on major economies could disrupt global trade flows, which would have implications for Indian industries with strong export ties. The IT sector, for instance, is highly dependent on the U.S. market, and any slowdown in economic growth there could weaken demand for IT services.

Similarly, tariff uncertainties often lead to volatility in commodity prices, which could impact Indian companies that rely on imported raw materials.

Additionally, escalation in trade disputes tends to trigger risk aversion among global investors, leading to fluctuations in stock market performance.Fed Meeting

Given these mixed signals, Indian investors should take a cautious yet strategic approach. Focusing on sectors that benefit from domestic economic growth, such as banking, consumer goods, and infrastructure, may offer more stability. Keeping an eye on global developments, particularly trade policies and FII trends, will be crucial in anticipating market movements. A diversified investment portfolio can also help mitigate risks arising from external uncertainties.

The Fed’s latest stance presents a combination of opportunities and challenges for Indian stock market participants. While rate cuts could support market growth, ongoing trade tensions may introduce volatility. Investors should remain adaptable, leveraging domestic growth while staying prepared for global economic shifts.

Also Read : Daily Horoscope for March 20, 2025: Zodiac Predictions by Guru Ji Dr. Raj

Categories

Categories