The Indian stock market, particularly the Sensex and Nifty, opened lower on Wednesday, facing pressure from key stocks such as Reliance Industries, Infosys, and banking stocks. This dip was attributed to mixed global cues, with losses in pharma stocks weighed down further by tariff threats from former U.S. President Donald Trump.

Key Highlights:

- RVNL saw a rise of over 6%, driven by a ₹554.47 crore contract win for the Bengaluru Suburban Rail Project (BSRP).

- Vedanta gained nearly 2%, bolstered by 83% creditor approval for its demerger plan.

- Nifty IT index dropped by over 1.2%, with investors waiting for the Federal Reserve’s January meeting minutes and signals of no imminent rate cuts.

- Tata Motors received an upgrade from CLSA to ‘High-Conviction Outperform’ with a target price of ₹930.

- European shares remained flat, with Antofagasta’s gains offsetting losses in the real estate sector.

Stocks in Focus:

- Tata Investment Corporation surged by 14.73% in early trading.

- Zen Technologies rebounded, hitting the upper circuit limit with a 10% rise after a significant drop in the previous sessions.

- Maharashtra Seamless promoters bought 5.5 lakh shares in a week.

Sectoral Updates:

- Nifty Realty emerged as a top sectoral gainer, jumping nearly 2%, led by companies like Brigade Enterprises and Godrej Properties.

- Meanwhile, pharma stocks faced a tough day, with Aurobindo Pharma and Dr. Reddy’s taking a hit due to Trump’s tariff threats.

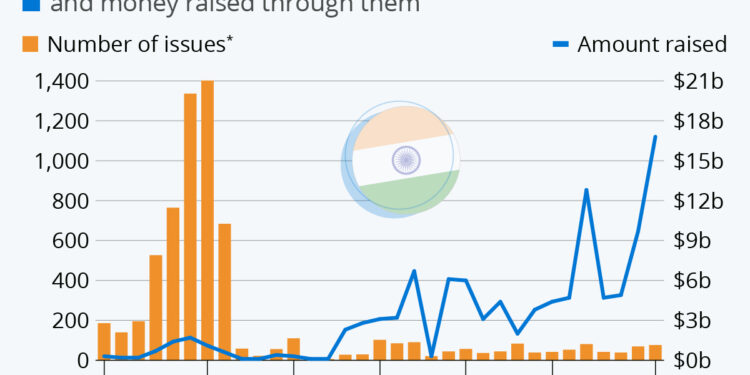

IPO Debuts:

- PS Raj Steel, Maxvolt Energy Industries, and Hexaware Technologies were set to debut on the SME platforms, with market sentiment mixed ahead of the listings.

Amidst the fluctuations, Nifty fell below 22,900 and global markets kept an eye on upcoming economic indicators, especially the Fed’s policy stance. Despite the volatile trading environment, India VIX eased over 1%.

This update provides a snapshot of a choppy market session influenced by global developments and sector-specific movements.

Disclaimer: This is an AI-generated live blog and has not been edited by Localtak staff.

Categories

Categories