UPI down today: Users across leading digital payment apps, including Google Pay, PhonePe and Paytm, were unable to complete transactions.

UPI Services Disrupted: Users Face Issues on Google Pay, PhonePe, and Paytm

Several users across India reported difficulties in completing transactions through popular digital payment platforms, including Google Pay, PhonePe, and Paytm, as the Unified Payments Interface (UPI) experienced an unexpected outage today.

The disruption has led to widespread inconvenience, especially for those relying on UPI for daily payments. Social media platforms were flooded with complaints and queries from users unable to send or receive money through their preferred apps.

Authorities are yet to issue an official statement regarding the cause of the disruption. Meanwhile, users are advised to keep alternate payment options handy while the issue is being resolved.

Major UPI Disruption Hits India, Third Outage in 30 Days

A significant technical glitch disrupted Unified Payments Interface (UPI) services across India on Saturday morning, leaving users across multiple platforms unable to complete transactions. This incident marks the third major outage in less than a month, raising concerns over the reliability of one of India’s most widely used digital payment systems.

Users took to social media to report failed transactions and delayed responses from UPI-enabled apps. While some services were restored after a brief period, the disruption impacted both personal and commercial transactions nationwide.

Authorities and payment service providers have yet to issue a detailed explanation regarding the root cause of the glitch. Meanwhile, industry experts are urging for stronger infrastructure resilience and faster contingency measures to prevent such recurring disruptions in the future.

users across popular digital payment platforms — including Google Pay, PhonePe, and Paytm — faced issues completing transactions today. The unexpected outage has caused widespread inconvenience for individuals and businesses alike, affecting daily payments, merchant services, and essential digital transactions.

A major disruption in the Unified Payments Interface (UPI) system caused widespread inconvenience to users across India on Saturday. According to DownDetector, a platform that tracks service outages, 2,147 user complaints were recorded by 12:56 PM, with nearly 80% of users facing issues specifically during payment attempts. Earlier in the day, 1,168 complaints had already been logged, indicating growing frustration among users.

The outage affected several major financial institutions, including HDFC Bank, State Bank of India (SBI), Bank of Baroda, and Kotak Mahindra Bank. Customers reported failed transactions, delays in payments, and app errors, impacting both personal and business transactions across the country.

This disruption comes just days after a significant policy update by the National Payments Corporation of India (NPCI). Effective April 8, the NPCI has restricted the use of QR codes for UPI payments made outside India, aiming to enhance payer identification and transaction security. However, QR code-based transactions within India remain fully operational and unaffected.

Widespread UPI Outage Disrupts Digital Transactions on March 26

On March 26, a significant disruption affected UPI (Unified Payments Interface) services across India, leaving countless users unable to complete digital transactions. Social media platforms were flooded with complaints, as users reported failed or delayed payments.

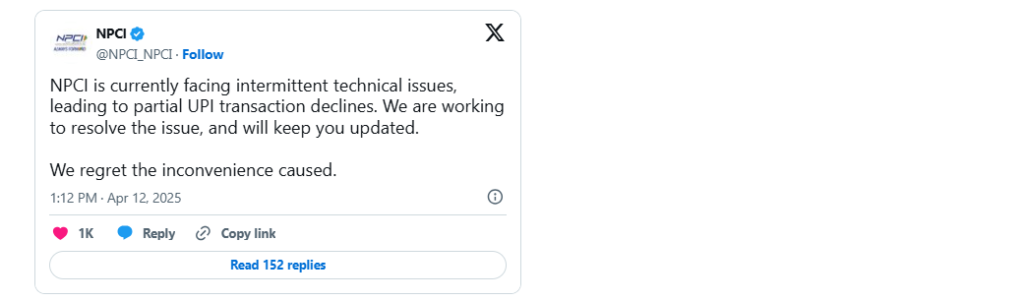

According to a statement issued by the National Payments Corporation of India (NPCI), the disruption was due to “intermittent technical issues” that caused partial transaction declines. The payment regulator confirmed that the issues have since been resolved and that UPI services are now stable.

“NPCI had faced intermittent technical issues owing to which UPI had partial decline. The same has been addressed now and the system has stabilised. Regret the inconvenience,” NPCI stated in a post on X (formerly Twitter).

While the outage was brief, it raised concerns about the reliability of the country’s most widely used digital payment system. Authorities have assured users that measures are in place to prevent similar incidents in the future.

UPI payments went down for a brief while again on April 2.

India Leads in UPI Transactions While Credit-Driven Payments Gain Momentum in 2024

India continues to set the pace in digital payments, with UPI (Unified Payments Interface) taking center stage in 2024. According to a report by fintech firm Phi Commerce, UPI has emerged as the backbone of India’s digital transaction ecosystem, accounting for a staggering 65% of all domestic payment transactions.

The report highlights a significant shift in consumer behavior—nearly one-third of all digital payments were credit-driven, powered by credit cards and EMIs (Equated Monthly Instalments). While UPI remains the preferred method for small to mid-value payments, credit-based options are increasingly popular for high-value purchases, particularly in education, healthcare, and the auto ancillary sectors.

Spikes in credit usage are often linked to festive shopping seasons, school admissions, and other periodic high-spend occasions, showcasing a growing trend where consumers lean on short-term credit solutions to manage larger expenses.

The findings are based on transaction data analyzed from over 20,000 merchants across India, offering valuable insights into evolving consumer preferences and the increasing importance of flexible digital payment options.

Read Also

UPI Outage Hits Again, Disrupting Payments on PhonePe, Google Pay, and Paytm 2025

Categories

Categories