Google’s $15 billion data centre investment heads to Andhra Pradesh, bypassing Karnataka — here’s why the tech giant chose the sunrise state over Bengaluru

Google’s decision to invest up to $15 billion in a massive new data‑centre and AI hub in the coastal city of Visakhapatnam in Andhra Pradesh has drawn global attention.What makes the story even more compelling is the fact that this investment appears to have been secured in preference to Karnataka, a state long considered India’s technology powerhouse.

So why did Google pick Andhra Pradesh instead of sticking with Karnataka or choosing Bengaluru again? What factors tipped the scale? And what does this mean for both states, for India’s tech infrastructure future, and for global tech investment strategy? This article dives deep into those questions.

The Announcement: Scale & Scope

In October 2025, Google confirmed that it would invest around $15 billion over five years in Andhra Pradesh to build its largest AI‑data‑centre outside the U.S. The facility is expected to include:

- A 1 gigawatt (GW) hyperscale data‑centre campus.

- Extensive renewable‑energy infrastructure (including new transmission lines and clean‑power generation) to support heavy compute loads.

- A subsea‑cable landing station and expanded fibre‑optic connectivity via the East‑coast gateway to link global traffic.

The move is seminal because it places India at the centre of global AI infrastructure growth, while also signalling that Google views India not just as a market for apps but a base for heavy data‑infrastructure build‑out.

Why Andhra Pradesh? The Pull Factors

Here are the key reasons that appear to have influenced Google’s decision to favour Andhra Pradesh:

1. Infrastructure Flexibility & Green‑Power Commitment

Andhra Pradesh has proactively framed itself as a “new investments corridor” – particularly in digital infrastructure and data‑centres. Under its IT & Global Capability Centres (GCC) policy, the state has offered land, power, and incentives aimed at large‑scale tech campus development. +1

Additionally:

- Officials confirm the project includes $2 billion earmarked for renewable energy as part of the data‑centre investment.

- The choice of Visakhapatnam, a port city on India’s east coast, offers proximity to subsea‑cable landings and international connectivity – a strategic advantage for hyperscale operations.

2. Land & Power Supply Advantage

Large data‑centres require abundant contiguous land, stable power supply (24/7), and major fibre/wireless connectivity. Andhra appears to have promised/secured:

- Expedited land allotments.

- Dedicated power‑corridors and transmission upgrades.

- Plans to develop multiple cable‑landing stations in Visakhapatnam, giving global routing advantage.

3. Competitive Incentives & “Green‑field” Opportunity

While Karnataka has an established ecosystem, it also has ecosystem + legacy costs, congestion, matured land markets, higher salaries and perhaps bottlenecks in ultra‑large‑scale campus build‑out. Andhra offered a more “blank‑canvas” scenario. According to Karnataka leadership, Andhra’s incentives included large tax breaks, free or subsidised land/power/water in some cases.

4. Strategic Positioning & Timing

Google’s global expansion of data‑centres is aggressive. India, with nearly a billion internet users, strong growth in cloud/AI, is a key growth market. Andhra’s eagerness, speed of approvals and clarity may have helped. According to one statement:

“When states compete, India wins.” — AP IT Minister Nara Lokesh

Additionally, Google likely wanted to anchor its infrastructure before regulatory, land‑or‑labor, and international supply‑chain complexities increased further.

5. Looking Beyond Bengaluru: Spatial Diversification

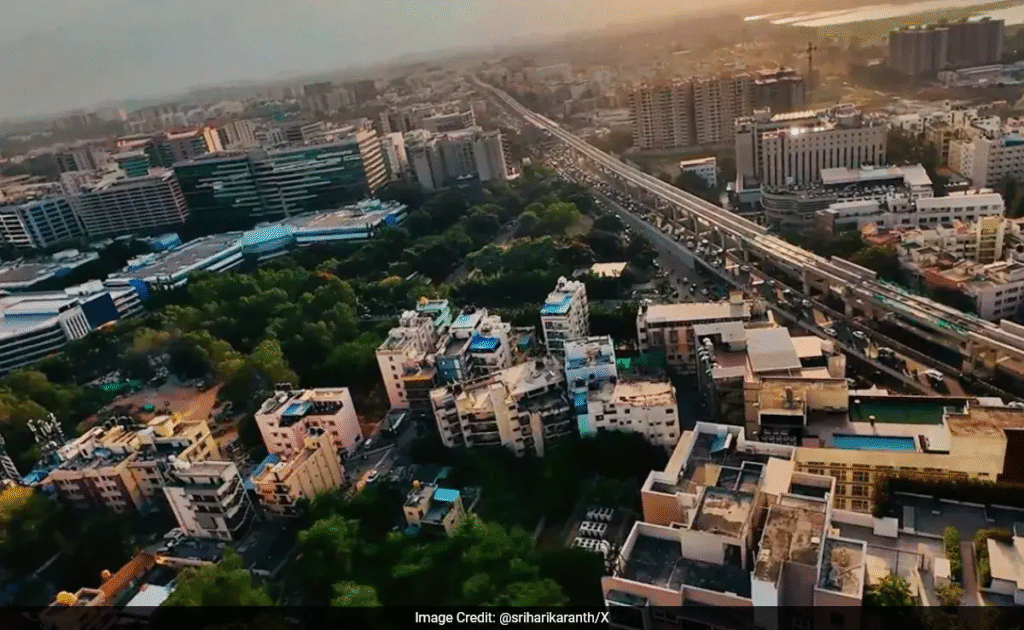

Bengaluru has long been India’s tech capital, but for ultra‑large infrastructure projects, there are challenges: urban sprawl, high land cost, traffic, regulatory complexity. For a 1 GW data‑centre campus, a port city like Visakhapatnam offers room for expansion, potentially smoother logistics (sea / rail) and fewer urban constraints.

Why Karnataka Lost Out (or Fell Behind)

While Andhra emerged as the winner, Karnataka appears to have missed the cut (or slowed) due to a mix of structural and policy issues:

A. Established Ecosystem, But Less Flexibility

Karnataka/Bengaluru already has major tech clusters, but perhaps lacked the “green‑field” space and ultra‑large contiguous land parcels needed for a 1 GW campus without major compromises.

B. Infrastructure & Growth Bottlenecks

Critics within Karnataka point to infrastructure issues: traffic, power‑grid constraints, water supply, land market saturation. Opposition and government figures have blamed policy paralysis.

C. Incentive Strategy & State Competition

Karnataka’s government appears to have taken a more cautious approach to incentives, warning against unsustainable giveaways. Meanwhile Andhra seems to have pulled out all stops to woo Google.

D. Timing & Speed of Clearances

In large‑scale investments, speed matters. The fact that Andhra had already signed MoUs, clearly outlined land/power/communications plan may have given them a “first‑mover” advantage in securing Google’s final decision.

Strategic Implications for India & Big Tech

For India’s Digital Economy

- The Google investment reinforces India’s transition from being a consumption market to a build‑out location for global scale data‑centres and AI‑infrastructure.

- With the facility slated to generate tens of thousands of jobs and indirectly enable large ecosystems, it could accelerate AI/cloud growth in the region.

- Coastal‐east India (Andhra) emerges as a possible rival to traditional hubs like Mumbai/Chennai/Bengaluru for next‑gen infrastructure.

For Big Tech Strategy

- Google’s pick signals that tech majors are valuing land, power, connectivity scalability and partner‑state flexibility even more than tradition tech‑city ecosystems.

- Hyperscale campuses, green‑power sourcing, undersea‑cable access are now key criteria – not just talent or market size.

- The precedent may spur future mega‑projects in other Indian states that position themselves effectively.

For State‑Level Competition & Policy

- The decision underscores the importance of “competitive federalism” in India – states competing fiercely for large investment projects.

- States that streamline land/power/fibre, enact investor‑friendly policies, and deliver quick approvals will have an edge.

- Karnataka’s loss may catalyse policy review: e.g., power‑grid upgrade to 765 kV for data‑centres.

Risks & Considerations

While the announcement is monumental, several caveats remain:

- Execution risk: Building a 1 GW data‑centre and associated infrastructure is complex. Delays in land/housing/connnections or regulatory approvals can slow roll‑out.

- Sustainability: Data‑centres consume large amounts of power and water. Ensuring renewable energy supply and environmental compliance will be key.

- Local ecosystem readiness: Generating local jobs is contingent on skilling, supply‑chain readiness, and supporting industries.

- Incentive burden: Generous incentives may carry long‑term fiscal risks for the state if not balanced with revenue generation. Karnataka environment flagged such concerns.

What This Means for the States & Industrial Landscape

For Andhra Pradesh

- A major win for its rebirth as a tech & infrastructure state after losing Hyderabad in 2014. Many view this as a cornerstone investment.

- It may pave way for further investments in data‑centres, undersea cable infrastructure, and digital‐infrastructure services.

- It offers potential for job creation, ecosystem development, open up ancillary industries (cooling, power, fibre, manufacturing).

For Karnataka

- A wake‑up call: Bengaluru remains strong, but for ultra‑large infrastructure, other states may now compete effectively.

- The state may need to sharpen its incentive policies, infrastructure upgrades (power, transmission, land parcels) and speed of clearances.

- The politics of investment will gain new intensity among states.

Conclusion

Google’s decision to pick Andhra Pradesh for its historic $15 billion AI‑data‑centre bet – over a traditional tech power‑house like Karnataka – signals a shifting paradigm in how global tech infrastructure is located in India. It is no longer just about talent or legacy ecosystems: land, power, connectivity, incentives, and state speed matter a lot.

For India, this deal may mark the beginning of a new wave of digital infrastructure expansion. For states, the message is clear: readiness matters.

As the project moves from announcement to build‑out, the world will watch whether Andhra Pradesh delivers, whether Karnataka can bounce back, and whether India can convert the promise of mega‑investments into real economic transformation.

Also Read : A number of early iPhone 17 Pro adopters face decolorization issues

Categories

Categories