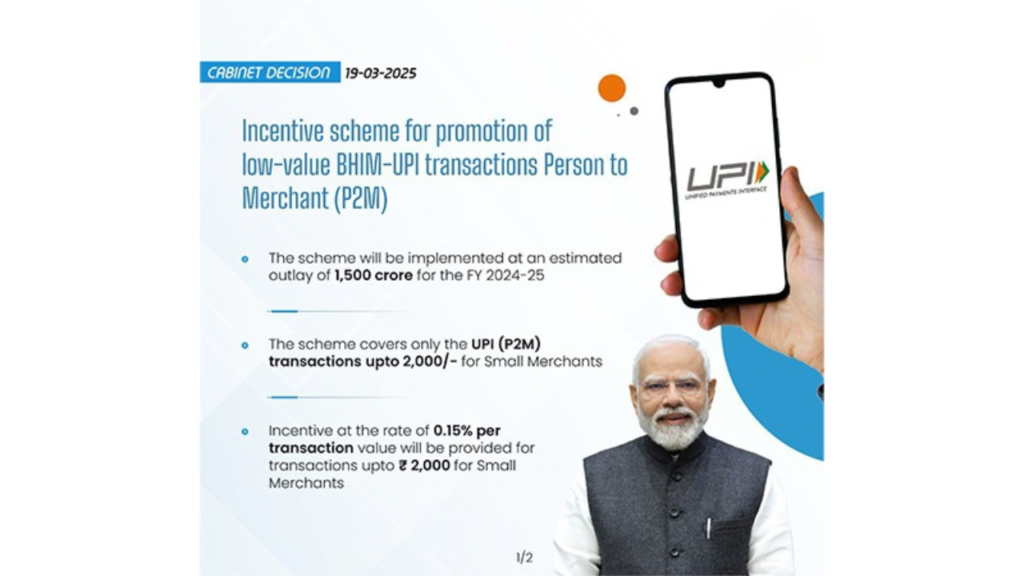

The Indian government has approved a new scheme to encourage small merchants to use digital payments through the BHIM-UPI platform. This scheme, called the ‘Incentive Scheme for Promotion of Low-Value BHIM-UPI Transactions (P2M), will run from April 1, 2024, to March 31, 2025, with a budget of Rs 1,500 crore.

The Indian government has introduced a new initiative aimed at promoting digital payments among small merchants through the BHIM-UPI platform. Named the ‘Incentive Scheme for Promotion of Low-Value BHIM-UPI Transactions (P2M),’ this program is designed to encourage businesses to embrace cashless transactions, fostering financial inclusion and digital adoption.

The scheme, which runs from April 1, 2024, to March 31, 2025, has been allocated a budget of ₹1,500 crore. It focuses on incentivizing low-value person-to-merchant (P2M) transactions, ensuring seamless, secure, and efficient payment experiences for both merchants and consumers.

With digital payments becoming a cornerstone of India’s financial ecosystem, this initiative is expected to drive greater UPI adoption, reduce dependency on cash, and support small businesses in their digital transformation journey. The government aims to strengthen the country’s fintech landscape by making transactions more accessible, convenient, and cost-effective.

In a bid to promote digital transactions for payments up to ₹2,000 and reduce dependence on cash, the government has introduced a new initiative aimed at supporting small businesses. This plan ensures that small merchants can benefit from the digital payment system without incurring additional costs, making transactions more seamless and efficient.

To encourage widespread adoption, banks facilitating these transactions will receive financial incentives. Under this scheme, banks will receive 80% of their incentive claims every quarter upfront, while the remaining 20% will be based on their service quality. Banks that maintain technical errors below 0.75% and ensure system availability of at least 99.5% will qualify for the full incentive, ensuring a smoother and more reliable digital payment experience for businesses and consumers alike.

This initiative reflects the government’s commitment to strengthening India’s digital economy and making cashless transactions more accessible to small businesses.

The latest government initiative is set to push banks to enhance their digital payment infrastructure, ensuring a smoother and more efficient experience for users. This move aims to improve service quality, expand accessibility, and drive innovation in the digital payments sector.

For customers, the scheme offers a seamless, secure, and cost-free transaction experience. By eliminating additional fees, digital payments become more attractive, especially for small merchants who have been hesitant due to extra costs. This initiative aligns with the government’s vision of a cashless economy, promoting financial transparency and formalization.

A key aspect of the scheme is its performance-based incentives for banks, ensuring that digital payment services remain reliable and widely accessible. The plan also focuses on expanding UPI adoption in smaller towns and rural areas through feature phone-based payments and offline solutions, making digital transactions more inclusive.

However, concerns have been raised regarding the allocated budget. Vishwas Patel, Joint MD of Infibeam Avenues and Chairman of the Payments Council of India, criticized the government’s decision to allocate only ₹1,500 crore for processing transactions worth ₹246.82 lakh crore in 2024. “With Zero MDR on UPI, this allocation is far from sufficient and will stifle the ecosystem’s ability to scale and grow. We expected an incentive above ₹5,000 crore, slightly higher than last year’s ₹3,500 crore. This ₹1,500 crore allocation is a grave injustice,” he stated.

As digital payments continue to evolve, the success of this scheme will depend on how effectively it supports banks, merchants, and consumers while sustaining growth in the digital payment landscape.

With the increasing costs of deployment, servicing, and compliance with RBI regulations, the growth of UPI transactions faces significant challenges. Industry experts warn that these rising expenses could stifle innovation and expansion.

Patel emphasized that businesses cannot solely rely on government incentives to sustain operations. The only viable solution, he suggests, is for the government to permit a controlled Merchant Discount Rate (MDR) of 25 basis points (BPS) on UPI P2M (Person-to-Merchant) transactions, but only for merchants with an annual turnover exceeding ₹40 lakhs. Smaller merchants, however, would continue to benefit from Zero MDR incentives to ensure accessibility and financial inclusion.

According to data from the National Payments Corporation of India (NPCI), UPI processed a staggering 131.12 billion transactions worth ₹200 trillion in the financial year 2024 (FY24). With over 400 million users, UPI now dominates 75% of all digital transactions in India, highlighting its crucial role in the country’s digital economy.

As discussions around sustainable monetization models continue, stakeholders hope for a balanced approach that maintains affordability for small businesses while ensuring the long-term viability of the UPI ecosystem.

Read Also

Categories

Categories